In this article, I will take you through a tour of invesment banking and how to test applications associated with it. Since the topic is very vast, I will take a small but important piece of it. I will cover trading life cycle and sketch out key scenarios for the same.

What is Investment Banking

Investment banking is a term that describes the business of raising the capital for companies and advising them on financing and merger alternatives. It doesn’t mean investing or banking. It’s a broader term that deals with capital and securities. Capital means cash which a company needs for its growth and securities are the bonds and stocks. Investment bank derives the cash by selling the securities to the public investors. An investment bank can be divided into front office, middle office and back office.

Why Investment Banking?

The investment banking industry finds its roots in the nineteenth century. In that era, the security markets of Europe and America were dominated by small partnership firms. All these firms had their origins in the 18th century Atlantic trade of importing goods for European manufacturing industry and exporting their finished products.

Another fact was, the traders who operated in this environment were pioneers and their legal difficulties were more complex due to multiple jurisdictions involved. Also, the communication speed in those times was no faster than the person himself who is sailing between the shores of two continents which made it very difficult to have close control over his operation in the other country. If these merchants had had to rely upon the court-enforced contracts of today’s economics text books, they would have been unable to operate. And hence they had to find alternative ways to make and to enforce binding agreements. This gave rise to some extra-legal modes of contracting and contract enforcement. Academic economists and lawyers have become increasingly aware of the importance to economic life of institutions that support this type of arrangement. For example, recent research has demonstrated that trading arrangements in medieval Europe were designed to support private enforcement, and many trade agreements in the modern diamond and cotton industries are also made outside the formal legal system.

In short, we can make a statement that financial markets cannot function effectively if agents with valuable information are unable to sell it to those who require it. This problem is particularly acute when new securities are issued, but it is also important at other times—when one firm purchases another, for example, or when loans to distressed corporations have to be renegotiated. Investment banks add value in these situations by designing an environment within which information will be produced, enforcing the private laws that govern its exchange, and acting as intermediaries between the investors and analysts who sell this information, and the investors and corporate security issuers who purchase it. Hence we can conclude that investment banks exist because they maintain an information marketplace that facilitates information-sensitive security transactions.

Functions of Investment Banking:

Investment banks have many functions to perform. Some of the most important functions of investment banking are as follows:

- IPOs: Investment Banks facilitate public and Private Corporation’s Initial Public Offering known as IPO (issuing securities in the primary market) by providing underwriting services. Other services include acting as intermediaries in trading for clients and foreign exchange management.

- Investment management: Investment Bankers also provide advice to investors to purchase, manage and trade various securities (shares, bonds, etc.) and other assets (e.g. real estate). Investors may be institutions (insurance companies, pension funds, corporations etc.) or private investors. The investment management division of an investment bank is divided into separate groups, namely, Private Wealth Management and Private Client Services.

- Boutiques: Small investment banking firms providing financial services are called boutiques. These mainly specialize in trading bonds, advising for mergers and acquisitions, providing technical analysis etc.

- Mergers and Acquisitions: Another major function of the investment banking include mergers and acquisitions (M&A) and corporate finance which involve subscribing investors to a security issuance, coordinating with bidders, or negotiating with a merger target.

- Structuring of Derivatives: This has been a relatively recent division which involves highly technical and numerate employees working on creating complex structured derivative products which typically offer much greater margins and returns than underlying cash securities.

- Merchant banking is nothing but the private equity activity of investment banks. Goldman Sachs Capital Partners and JPMorgan's One Equity Partners are the current examples. (Note: Originally, "merchant bank" was the British English term for an investment bank.)

- Research is another important function of an Investment bank which reviews companies and writes reports about their prospects with "buy" or "sell" ratings. Though this division does not generate direct revenues, the information gathered or produced by them is used to guide investors and in some cases for Mergers and Acquisitions.

- Risk management is a continuously ongoing activity which involves analyzing the market and credit risk that traders are taking onto the balance sheet in conducting their daily trades, and setting limits on the amount of capital that they are able to trade in order to prevent 'bad' trades having a detrimental effect to a desk overall.

Trading Life Cycle -

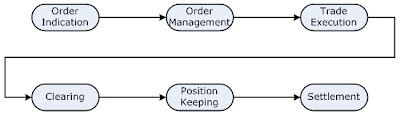

As we have seen, an investment bank provides services such as trading of derivatives, fixed income instruments, foreign exchange, commodities, and equity securities. Let's take tour of trading module. The trade life cycle has below stages, each trade has to undergo from the stages which are mentioned as below.

- Order Indication

- Order Management

- Trade Execution

- Clearing

- Settlement

Before going in details about these stages of business cycle, first we take a one glimpse of the complete trade flow which is in the below figure:

Order Indication:

The purpose of this stage is to “Placing an Order”. At this stage it is assumed that the research has already been made on the Investment Decision by Investment Manager regarding to that what to buy or sell and how much to buy or sell and at which prices. The decision on what to buy depends on the investment objective and the existing portfolio and its quality. Once the research and decision is made, client places an order on the basis of the decision taken by Investment manager. This order can be placed directly on the exchange by client or he may take help from broker to place the order. So we can classify the orders as below on the basis of how the client places the order:

Order Management:

This is the second stage of Trade Life Cycle. The purpose of this stage is to maintaining the order status, keep management of client/ broker orders and order reporting. Once the order has been placed/ executed successfully, it will appear in the Order Management System with an Order status. And this is updated during the life-cycle of the Order. The order status describes not only the order's current state, but also determines what, if any, actions a user can perform on the order.

Trade Execution:

Trade is a basic economic concept in which multiple parties participating in the voluntary negotiation and then the exchange of one’s goods and services for desired goods and services that someone else possesses. And Execution means the buy or sell of particular good and services. So Trade Execution means the completion of Buy or Sell Order of a Security for which multiple parties are participating. In this stage, Client gives the account information either while placing the order or after the trade execution is done.

Order Types:

- Limit - An order that is placed with a specific price mentioned in it. For buying, price less than or equal to the mentioned price is valid, for selling, price greater than or equal to is valid.

- Market – An order that is placed to be executed at price whatever is available in the exchange at that point of time.

- Stop/Stop Limit – An order that is placed with a limit price and a stop limit price. This order turns to Limit order once the prevailing price in Exchange reaches the mentioned Stop Limit price.

Clearing

- Determining the net effect of multiple payment orders

- How much does each party owe or is owed?

- Stands between the buyer and the seller as counterparty of both contractual partners

- Guarantees the fulfilment of all transactions

- Clearing House takes the principal risk

Settlement system:

Settlement is the sixth and last stage of Trade Life Cycle. Once the open/close positions are updated in the Position Keeping System, trade detail flows down to the Settlement system. Under this stage, the Settlement system checks for a Give In or a Full Service trade and also for Commission rates which are applicable for based on the counterparty involved. Then calculated internally, generated commission rates and some certain output reports also generated which contains the quantity, price, account, commission rate, Give In & Full Service.There is one assumption for this stage and that is: the Order is allocated and all required static data for markets & trade data are configured in the Position Keeping & Settlement System.

Test Scenarios -

We now have sufficient knowledge about the trade life cycle in order to design test scenarios.

Scenarios for Order Indication

Let us start with Order indication. Order indication helps one to finalize the trade details like, quantity, price at which you want to buy / sell, with which broker you want to deal with, currency in which you want to do settlement, option of Domestic or International trading, date on which you want to book the trade and so on. The tester creates scenarios based on following questions: what should be trade date, what should be Settlement date, what’s the max one can buy or sell, what if we have not give unique identifier of the security . So you need to validate all these fields before placing your trade.

Business validation could be like…

- Trade date and settlement date should not be holiday or Weekend.

- Quantity should be in number and not in decimals.

- Settlement date should be T+3 for US

- Security id (e.g ISIN, SEDOL) which is used should be correct.

- Each trade should have unique reference so that there wont be any duplication of trade.

And so on…

Scenarios for Order Management and Trade Execution

Next thing is that once the order is placed you need to monitor the different stages of the trade status like Initially it would be in New then it will go into Auth (Authorized trade) but say if there is anything which violates the business logic like by mistake you put the trade date as Holiday or weekend then system has to validate that and trade should go into Rejected status. Broker can change this status by correcting the data and it will again move to next step. Once the business data is validated trade will be sent to settlement system depending upon the security and nature of the trading like domestic or International. If everything is ok trade will get booked and if not trade will get failed.

Now in this case what we need to verify is that if the trade got booked properly then we need to verify that Actual amount is calculated correctly or not like quantity * Price * Factor plus minus commission.

Scenarios for Clearing and settlement:

Clearing and settlement are physical entities which take part into trading cycle once trade got matched and confirmed. Let us discuss how it work in real life so that you will get clear idea.

Clearing and settlement are the final two processes in trade processing cycle. Before proceeding to clearing, all the participants must have agreed to the trade details going through the above mentioned processes.

Clearing:

This is a process of exchange of money and securities between brokers using a form of netting. The clearing system nets all the trades done by all the brokers throughout the day.

There are two forms of netting

- Bilateral Netting – This means arriving at net obligations (i.e. netting) of securities and funds between two brokers / parties.

- Multilateral Netting – This means arriving at net obligations of securities and funds between all the brokers. Thus at the end of the day, exchanges arrive at a net position in securities or funds for each broker.

Lets take example of Bilateral netting, say if Broker x is doing trading with two clients as Client 1 and Client 2. Client 1 has got position as 400 and Client 2 has got position as -200 so net position is 200 so Clearing system has to transfer theses 200 position on Brokers account.

Clearing and settlement are physical entities and can not be simulated into testing but say in case if there is any mismatch from either client side or Broker side Clearing will not happen and trade will get rejected and Final status of the trade would as FAIL. On similar line settlement of cash would take place.

Settlement:

This is the last process in the Life Cycle of a Trade. In settlement all the counterparties

Exchange securities and money as per their obligations.

Lets take example of Broker A (Buying broker) and Broker B (Selling broker) wants to do the settlement so in this case NSCC (National securities clearing corporation) and DTC (Depository trust company) play vital role.

- Broker A send instruction to Exchange for Buy order

- Broker B send instruction to Exchange for Sell order

- Exchange will send the Trade details to NSCC

- NSCC send to Broker A details of all trades and net cash position and securities position to be settled.

- NSCC send to Broker B details of all trades and net cash position and securities position to be settled

- NSCC sends instructions to DTC with net securities position to be settled

- DTC transfers ownership of securities electronically from selling brokers account to NSCC account and from their buying broker's account

- Funds are sent or received by broker's settleing bank's from DTC to complete the settlement.

So in this way final settlement is done. This is definitely bit tricky to test.

References -

“History of Investment Banking”

- Nanda, Delong and Roy

- Valentine V. Craig

No comments:

Post a Comment